While 2022 was in some ways a “return to normal” for many industries and organizations, digital transformation is far from over. Customers are demanding high quality, digital service experiences, and this is pushing both digital-first and transforming enterprises to introduce more AI-powered automation into their CX processes.

“Industry adoption of virtual assistants (VAs) is expanding beyond banking and telecommunications with retail, manufacturing and healthcare rapidly adopting and gaining value from this technology.”

- Gartner

But what does that look like? Where should you start?

Ada is a data-driven organization; we always look to the numbers to gain insights and inform decisions, and we want you to be able to do the same.

To that end, we’ve anonymized and aggregated the hundreds of millions of automated interactions that Ada powered in 2022, and we’re using that data to identify key customer behaviors and predict trends that will help CX leaders plan strategically for the upcoming year. Let’s dive right in.

automated interaction growth by vertical

The global pandemic was a market maker for many brands and industries. While digital interactions skyrocketed in 2020 across the board, we’re now seeing volumes simmer down in some industries and continue to rise in others.

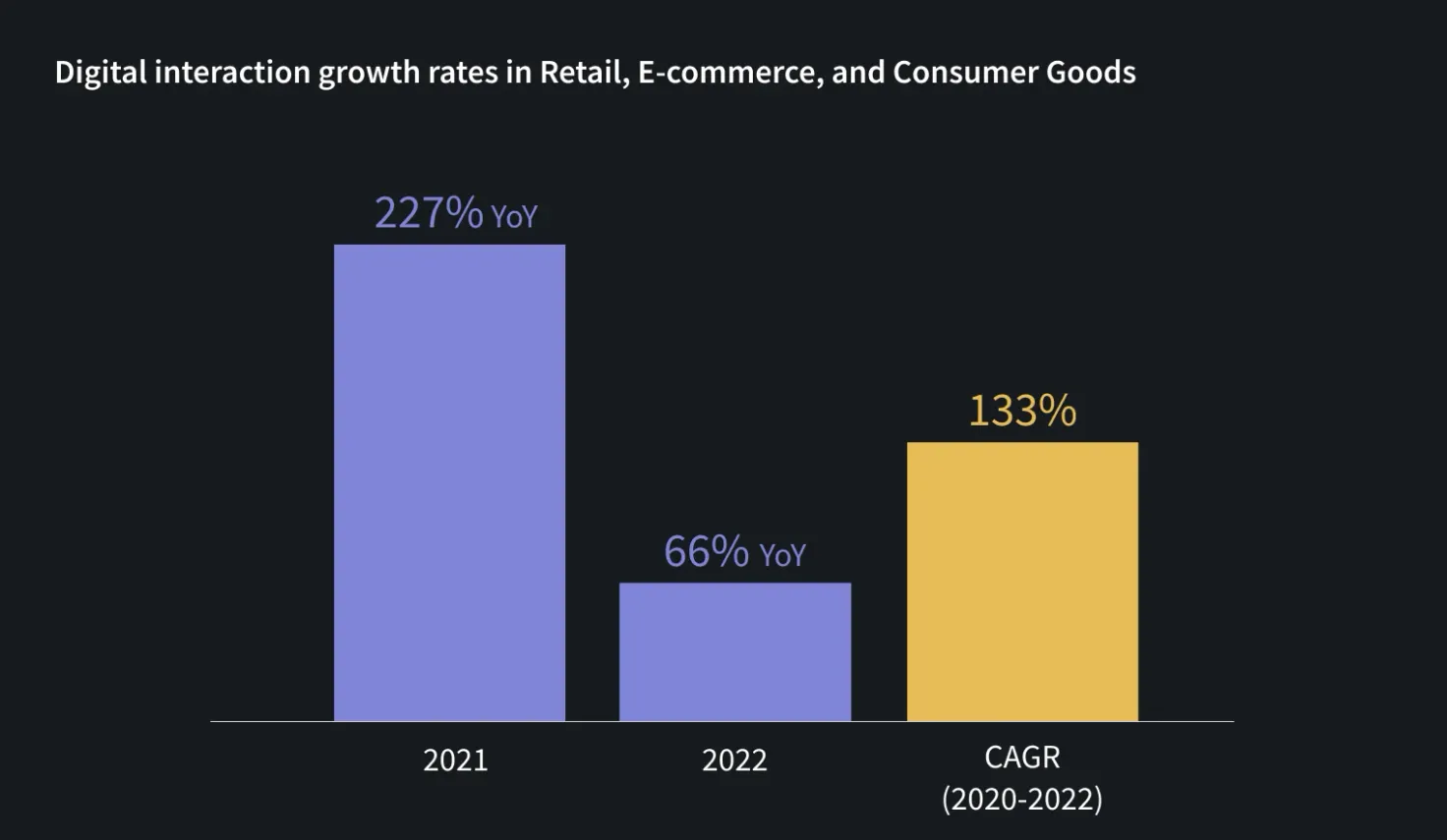

retail, ecommerce, and consumer goods

In 2021, even as lockdown measures started to relax, customers primarily still preferred to get service online. Automated interactions in Retail, Ecommerce, and Consumer Goods saw a 227% year over year (YoY) growth in 2021. Brands that invested in automation early on continued to see the return: an ability to predictably handle massive spikes in digital interaction volume while making sure costs, agent queues, and headcounts didn’t go through the roof as well.

In 2022, automated interaction volumes for Retail, Ecommerce, and Consumer Goods grew by 66% YoY, with an overall compound annual growth rate (CAGR) of 133%. It’s become clear that shoppers are now expecting the rapid, round-the-clock digital service they got used to during the pandemic, so Retail and Ecommerce brands would be wise to continue investing in automation.

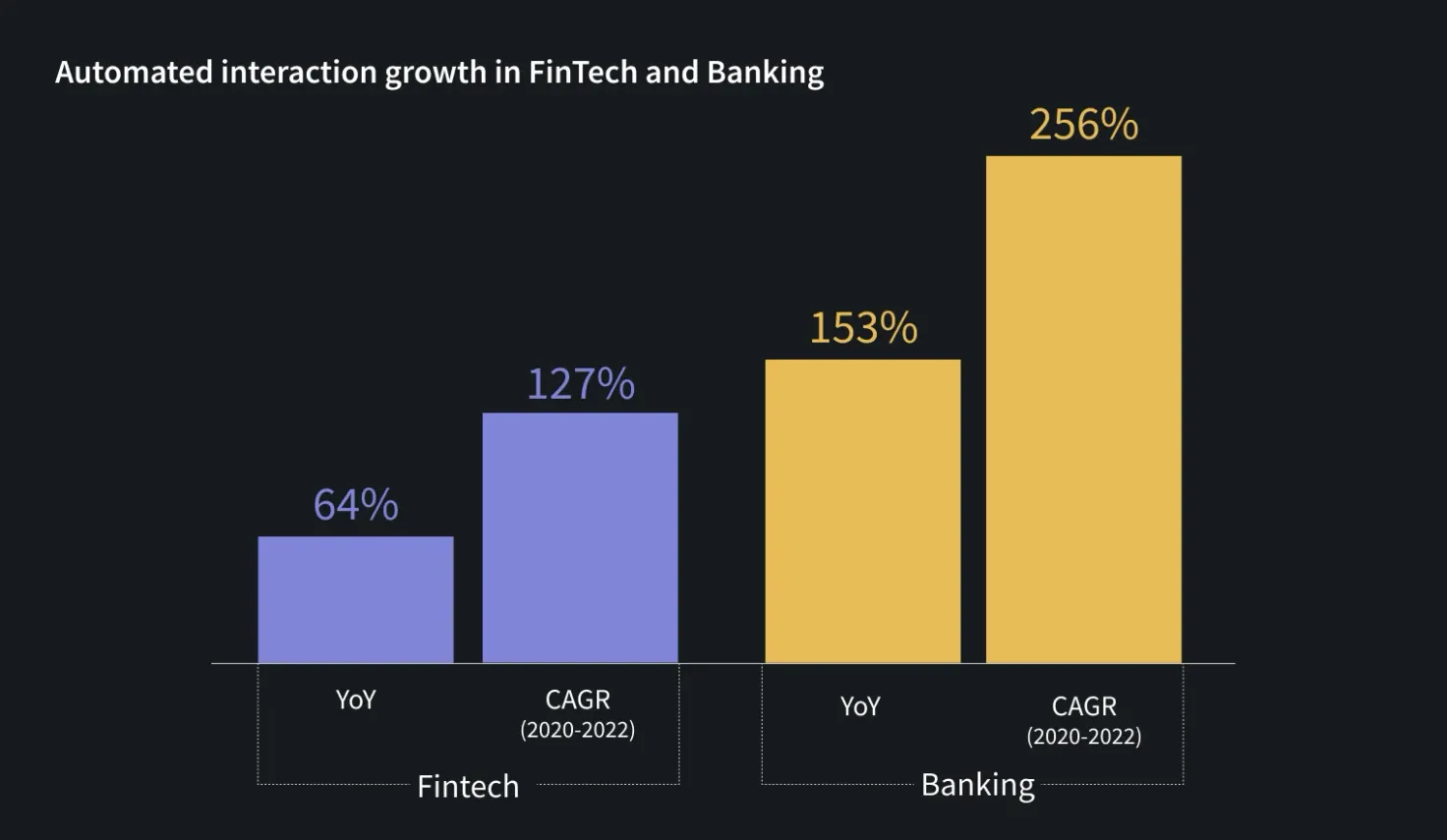

banking and fintech

Banking and FinTech ranked among the highest in YoY automated interaction growth, at 153% and 64% respectively. This suggests that customers in the Finance vertical are rapidly moving to digital channels. According to Gartner, “Banks and securities organizations are gaining business value with a strong correlation for increasing customer satisfaction and improving operational efficiency.”

gaming and sports betting

Regulations around online gaming and wagering have evolved in recent years, with many countries loosening restrictions — and opening up a world of opportunity. According to Statista, the global market for online gambling and betting was valued at USD $61.5B in 2021 and is expected to reach $114.4B by 2028.

As this vertical experiences rapid growth, many gaming and gambling platforms are turning to automation to keep up with the influx of new inquiries. Automation also adds a satisfying element of instant gratification to the customer experience for this fast-paced industry.

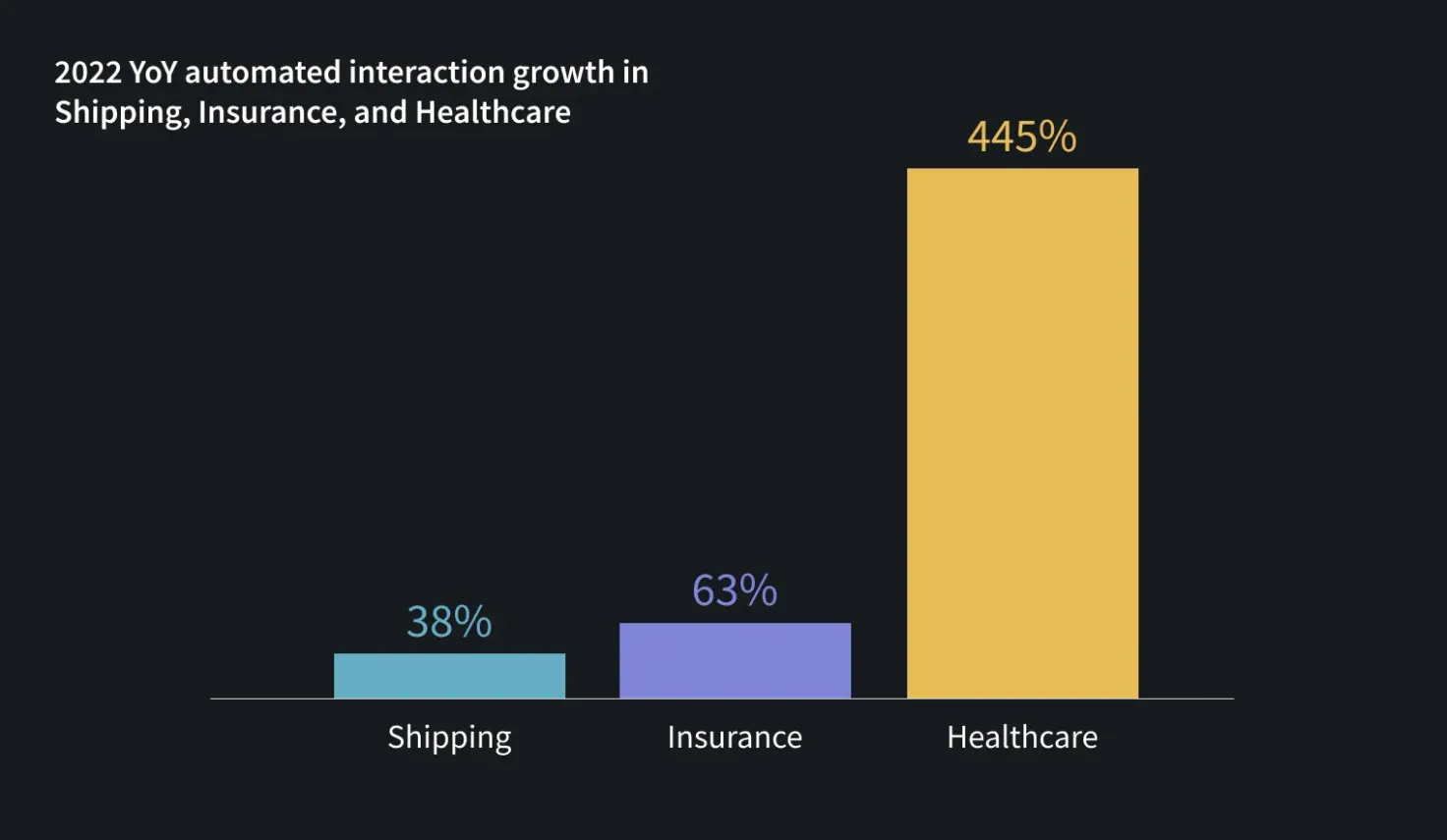

shipping, insurance, and healthcare

Industries and enterprises that have continued to rely on live customer support are also starting to embrace automation, as demonstrated by increased automated interaction volumes in 2022. For example, the Shipping, Insurance, and Healthcare verticals all saw positive YoY growth — some of which was significant. Healthcare saw enormous growth over the previous year, and Insurance also jumped considerably.

According to a recent Gartner report, even the public sector is getting in on automation, “The government sector is a late adopter of VAs, but the pandemic was a trigger for VA adoption with public/business value around enabling 24/7 support for citizens and, thus, improving customer satisfaction.”

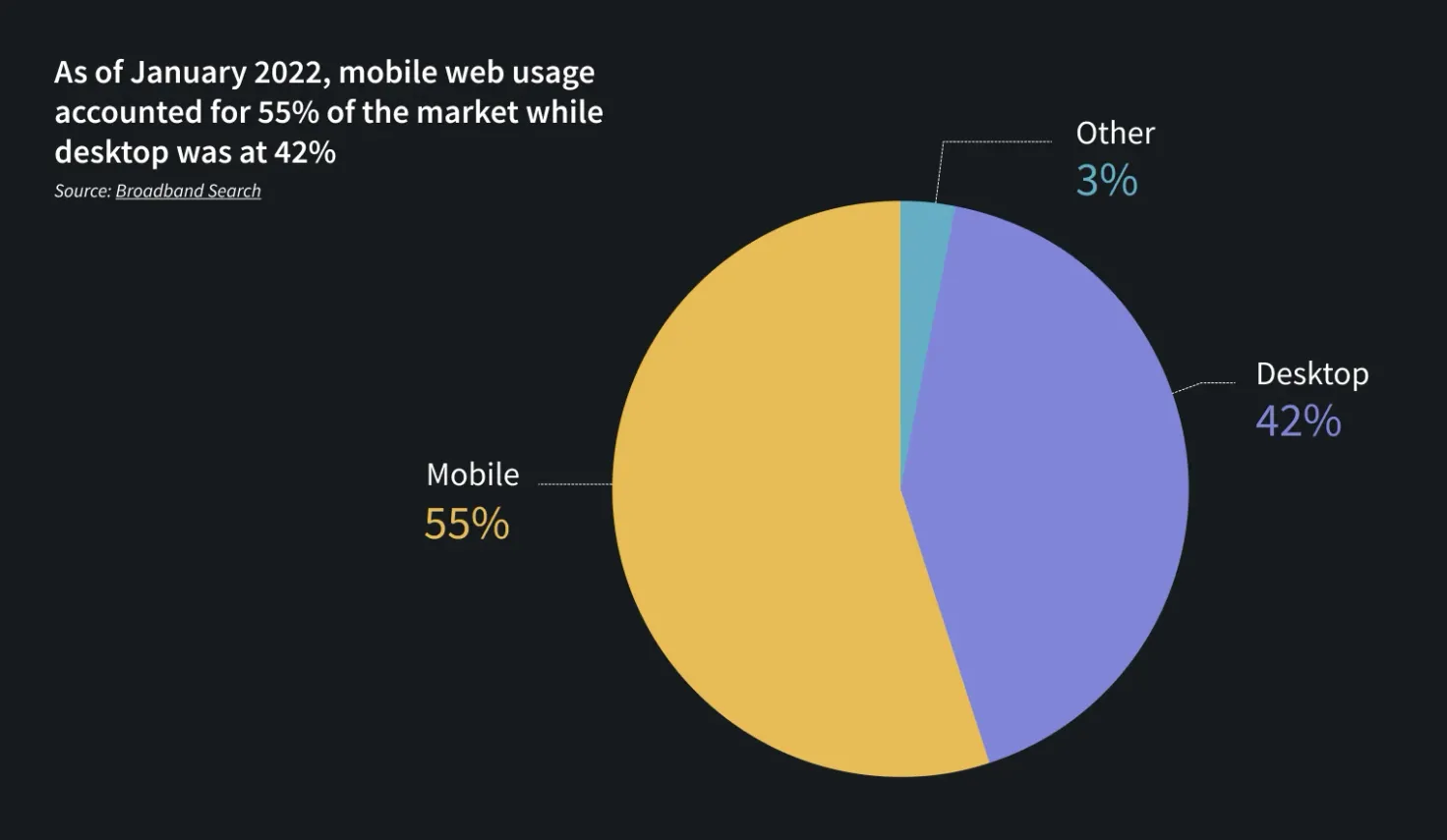

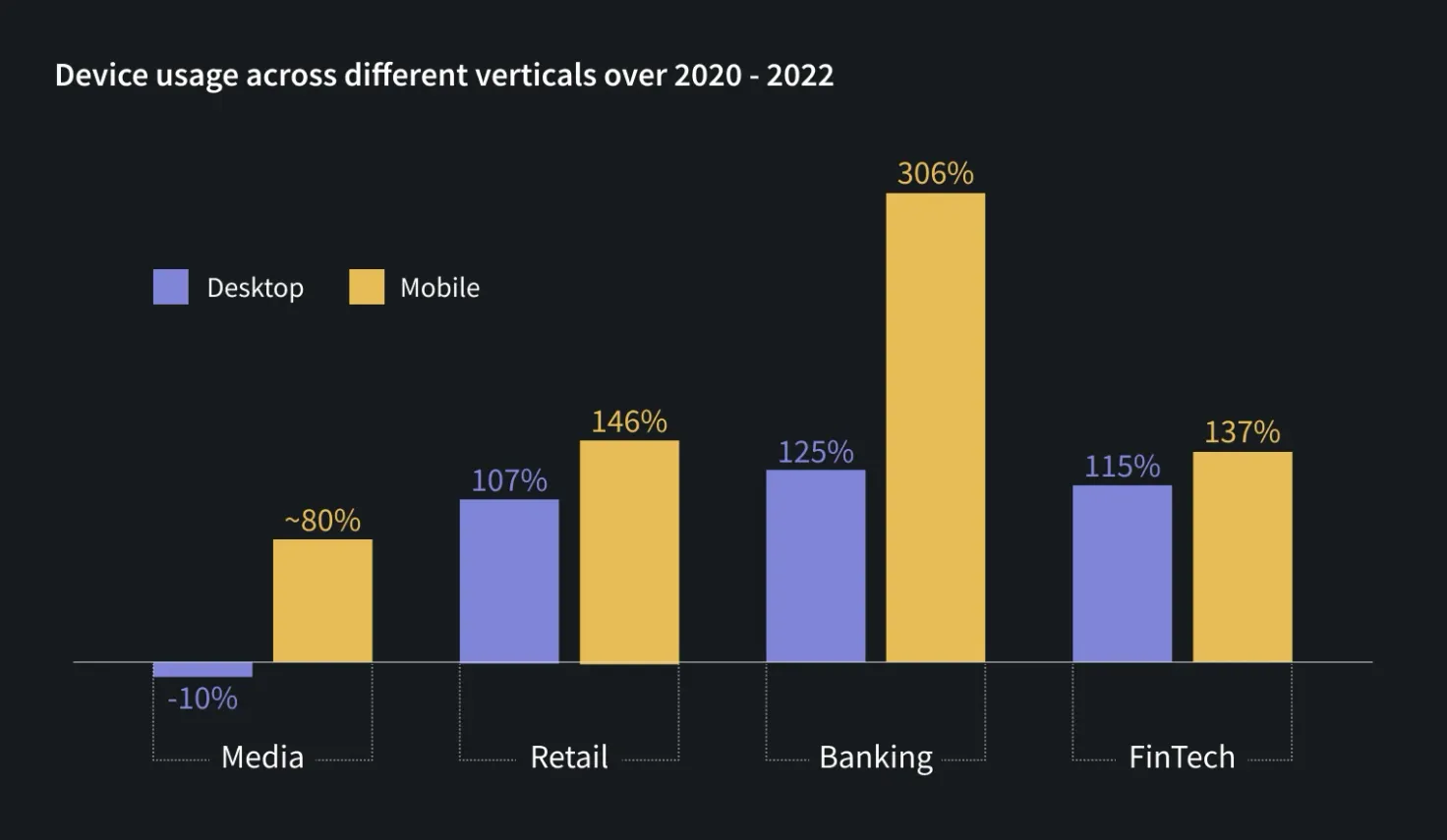

device data shows mobile is still on the rise

Overall, our data suggest that consumers are using their mobile devices to connect with brands more and more. In 2022, while device usage varied across verticals, mobile growth on the whole outpaced desktop growth. Brands are recognizing this as reflected in their continued investment in mobile software development kits (SDKs) to provide a better mobile experience for customers.

This upward trend in interaction volume applies across the board; the verticals that are seeing consistent YoY growth in mobile use align with overall consumer trends. Banking, Retail and Ecommerce, Media, FinTech, Insurance, and Consumer Goods all saw rising automated interaction volumes stemming from mobile SDK investment.

omnichannel & multimodal: the next frontier

The days of customers interacting with brands via a single touchpoint are long gone. In today’s always-on world, customers can be in 20 different channels and devices on the same day — and brands are realizing they need to do the same. That’s why businesses are starting to make themselves available across all the channels their customers are using. While early adoption has been relatively slow, Gartner predicts multimodal interactions will continue to increase in the next few years as more and more brands realize their potential value.

According to our own data, chat is still the primary mode of digital messaging across verticals, with Banking seeing the largest YoY growth of 147%.

Banking saw 147% YoY growth in 2022, the largest increase for automated chat interactions by industry.

new support channels gaining traction

Outside of web and mobile chat, Facebook Messenger and WhatsApp are the most popular customer support channels for Ada customers, a trend that likely holds true across the industry due to overall adoption. That being said, Ada users are expanding automation to offer support on new channels, including SMS, WhatsApp, Twitter, and Instagram. According to our data, customers across the Travel, Retail/Ecommerce, SaaS, and FinTech verticals are most likely to use channels outside of web or mobile, with Facebook Messenger, WhatsApp, and Twitter being the most-used channels.

In 2022, automated FinTech interactions on Facebook Messenger increased 115% YoY.

the “shop everywhere” effect

It’s worth noting that the brands embracing social channels are primarily in the B2C space; Travel and Retail, for example. These verticals have started to invest more in automating support for channels like Twitter and Instagram. This may stem from the larger trend towards “shop everywhere” experiences, which taps into the consumer preference for mobile shopping and makes it even easier for them to purchase on the channels they’re already using.

Social shopping on Instagram and YouTube, for example, now enables customers to complete purchases without ever leaving the app. This ability has also given rise to influencer shopping, where customers are able to buy the products influencers are using and promoting directly from their feeds. Voice assistant shopping is also available via popular apps like Siri, Alexa, and Google Home. With consumers no longer even needing to visit a company’s website to make a purchase, brands need to offer support everywhere their customers are buying — and automation is the key.

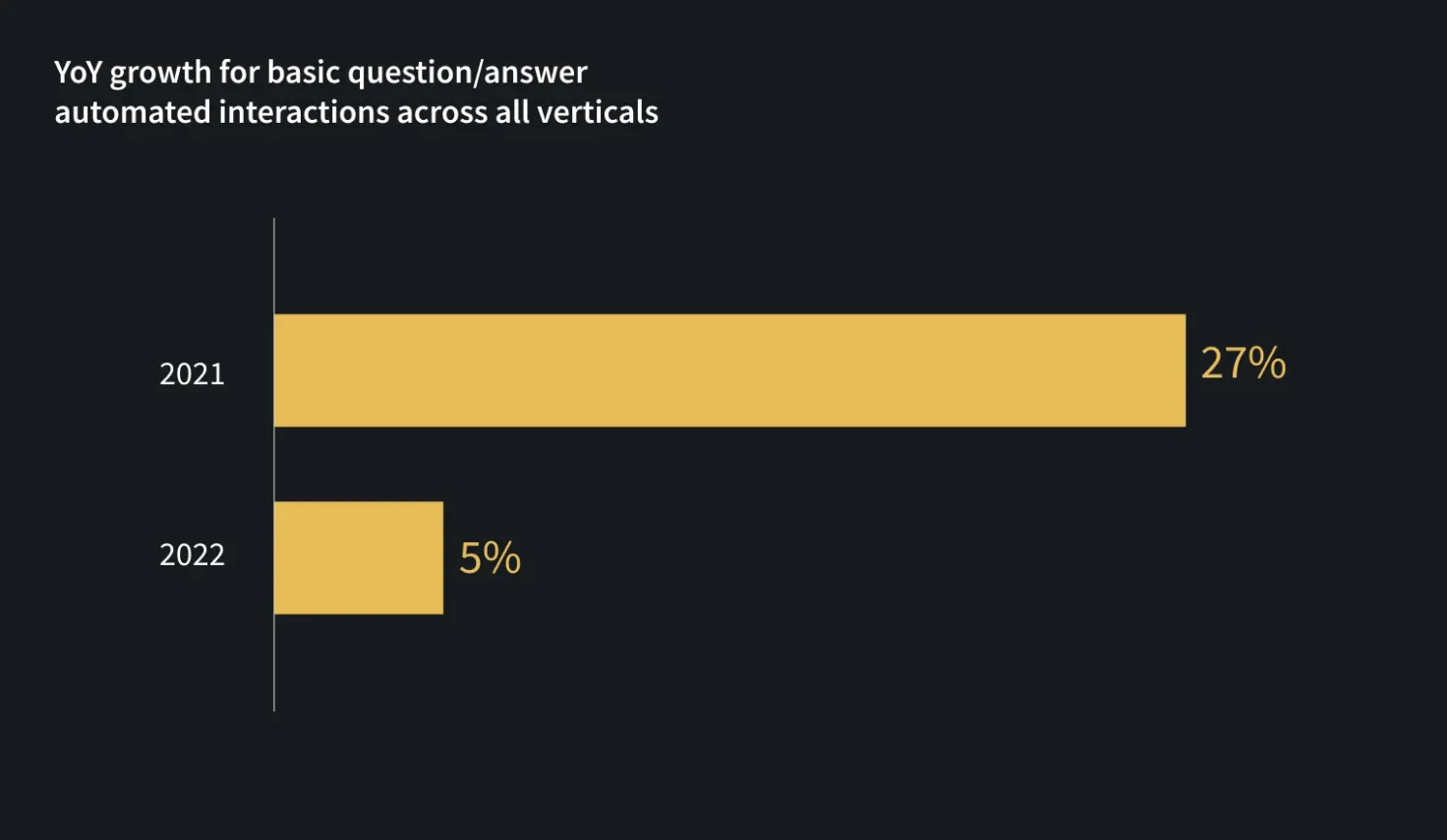

basic interactions take a back seat

Overall, we saw significantly higher growth in 2022 for experiences that include personalization and the ability to take action than we did for the basic question and answer type interactions. This suggests that in 2021, brands focused on automating every possible basic answer in order to keep up with the massive increase in digital interaction volume. Now that things have settled back down, they’re investing more time into actionable experiences — the next step.

time to take action

Brands are investing in making experiences more actionable and personalized so they don’t get left behind. For the last three years, automated interactions that empower customers to take action (such as make a return, change a subscription plan, modify a flight, and more) have seen greater growth than the basic answer category.

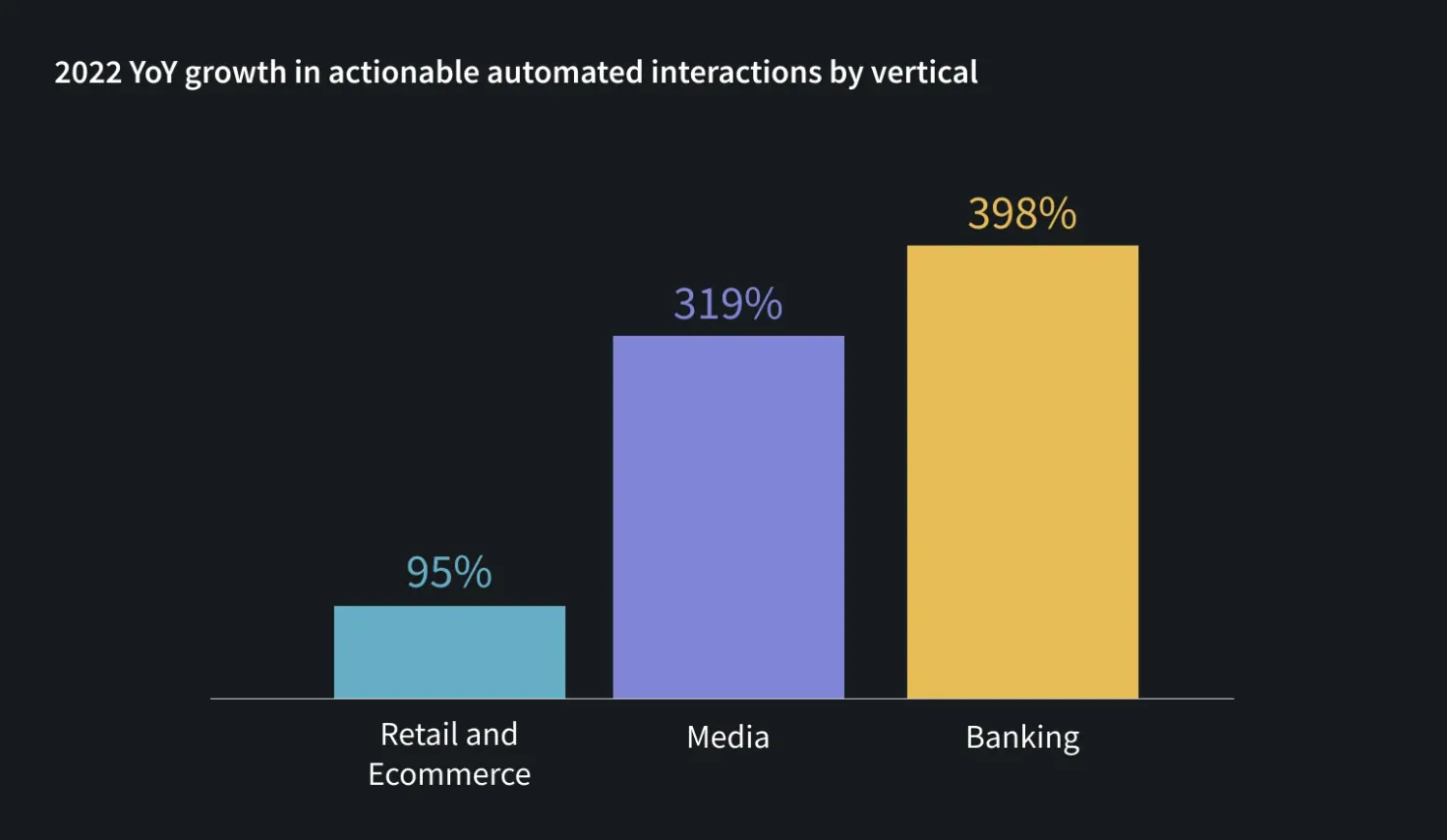

Media, Banking, and Retail and Ecommerce in particular saw huge actionable automated experience growth in 2021 with brands investing in at an even higher rate in 2022: Actionable automated interactions went up 398% among Banking customers in 2022, with Media close behind at 319%. Retail and Ecommerce also saw an impressive 95% YoY growth in these action-oriented interactions. We’ll definitely be keeping an eye on this metric in 2023.

the need to anticipate customer needs

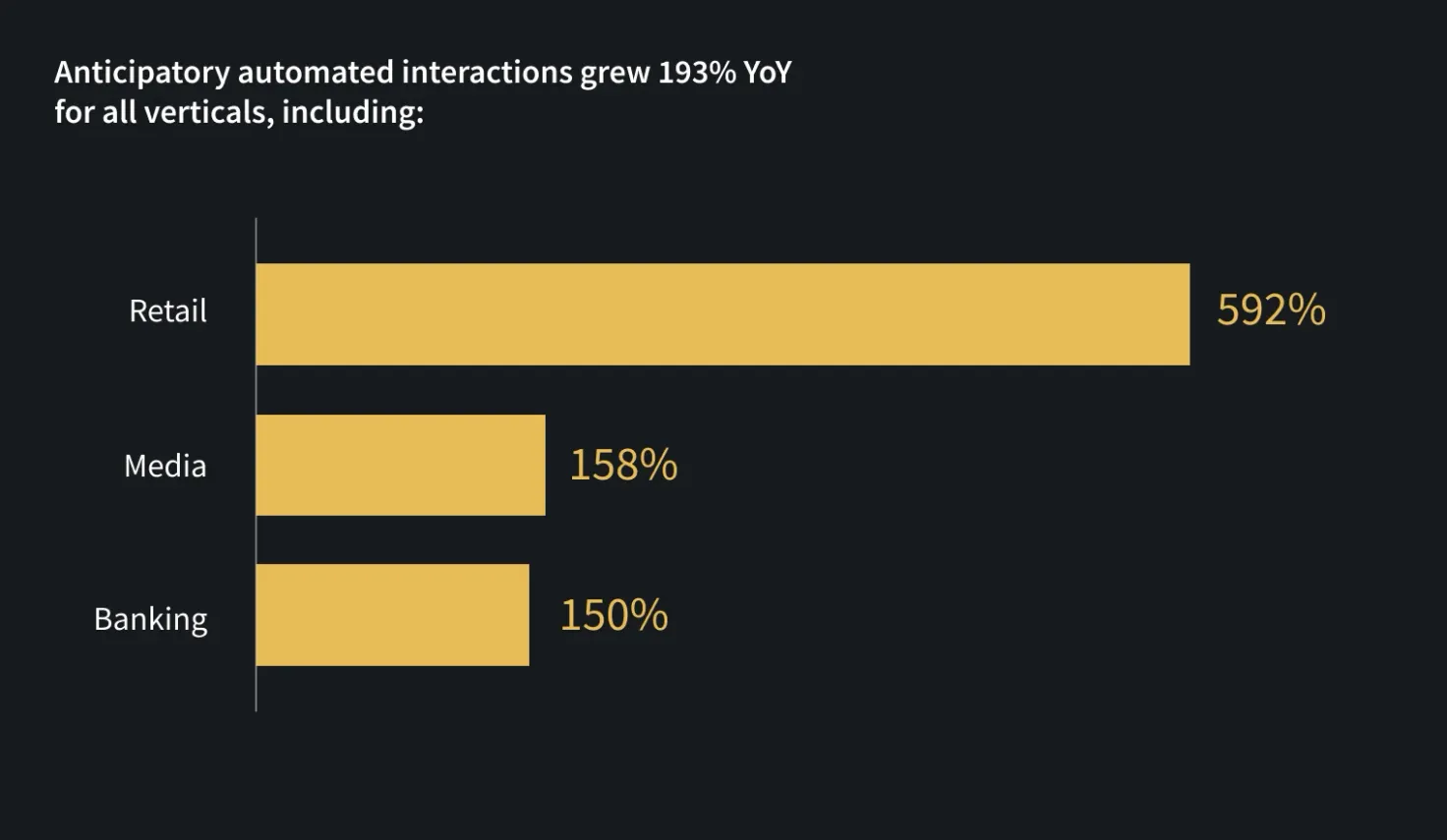

Anticipatory automated interactions, which use available customer data to predict what they’re trying to do and proactively offer support, also saw massive growth in 2022 with a few key verticals investing heavily in this type of experience — far more than we saw in the previous year. Anticipatory automated interactions in the Media vertical, for example, increased by 159% compared to the previous year, with Banking close behind at 150%.

It’s no surprise that Retail, which saw a whopping 500%+ YoY growth, is the most active in this category, with brands personalizing promotions based on a wide range of customer data, proactively offering support that’s relevant to recent activity, and so on. In 2020/2021, Retail and Consumer Goods brands saw considerable growth in both answer and action type automated interactions as brands scrambled to keep up with increased COVID-driven demand. In 2022, they spent more time building actionable and anticipatory automated experiences.

While there’s still much room for improvement in anticipatory engagement, we’re happy to report that Ada’s clients have done a lot of experimenting in this area — and we expect to see even more improvement in 2023. Brands across industries can learn a lot from Retail in particular when it comes to adding value by being proactive and personalizing, both of which are expected by today’s digital-first customers.

key takeaway: automation is on an upward trend

Overall, Ada’s 2022 customer interaction data tells us that brands are getting better and better at using automation to provide world-class customer support across channels and devices. And in light of the trends we’ve highlighted here, we expect it will continue to get better in the year ahead. We’re looking forward to helping brands everywhere deliver better brand interactions, and drive better outcomes.

the generative AI toolkit for customer service leaders

Evolve your team, strategy, and tech-stack for the AI-first future.

Get the toolkit