Bank on a FinTech AI Agent

Drive adoption and reduce costs by offering helpful guidance and instant resolutions to customer inquiries.

Keep pace with demand — without breaking the bank

Looking for the most efficient way for your customers to self-serve their most common and critical inquiries? Ada's AI Agent has industry expertise in FinTech.

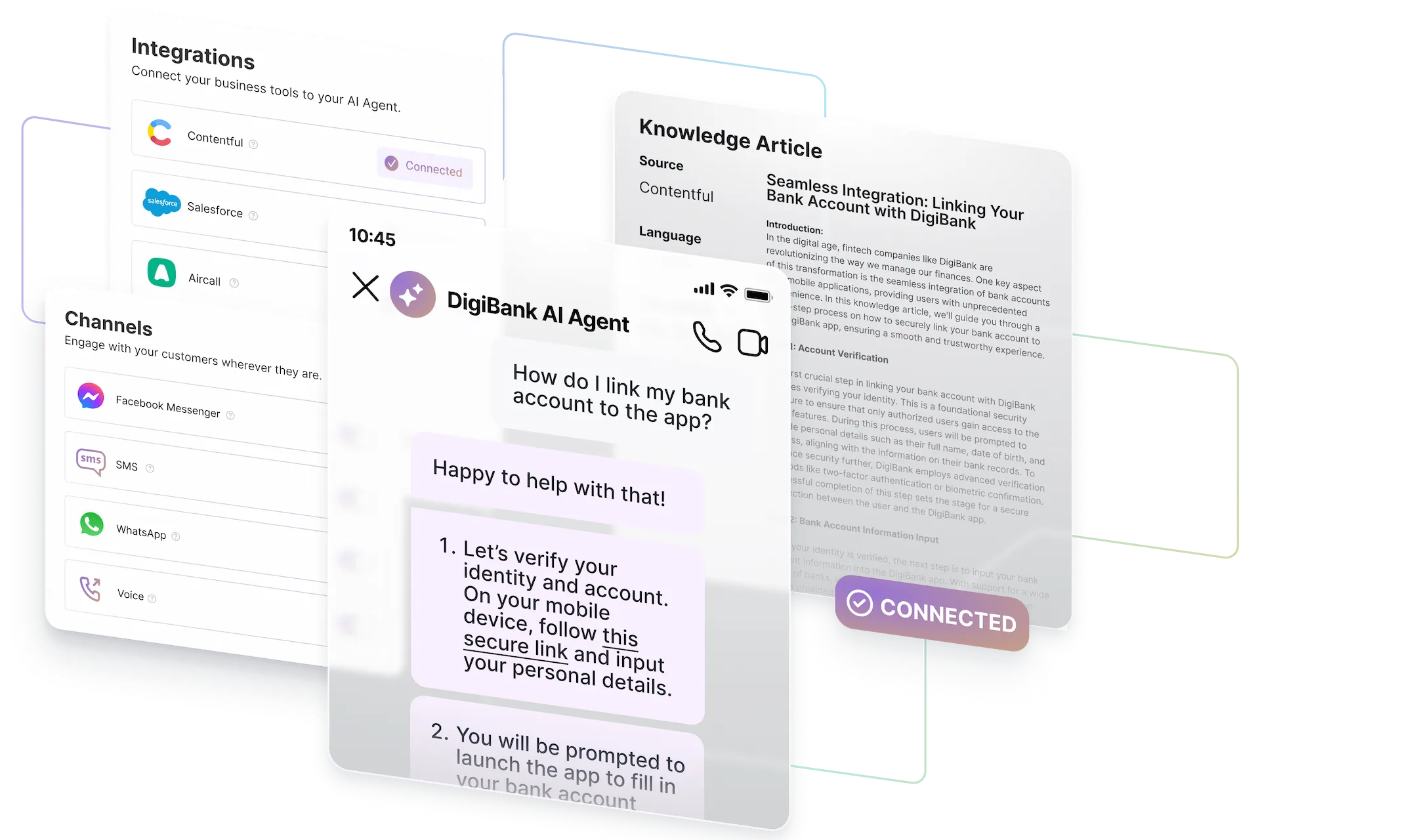

Effortlessly educate and onboard. Reduce drop offs.

Provide valuable digital banking education to your customers from day one. Guide them on account set up, funding, applications, and more to encourage usage and loyalty.

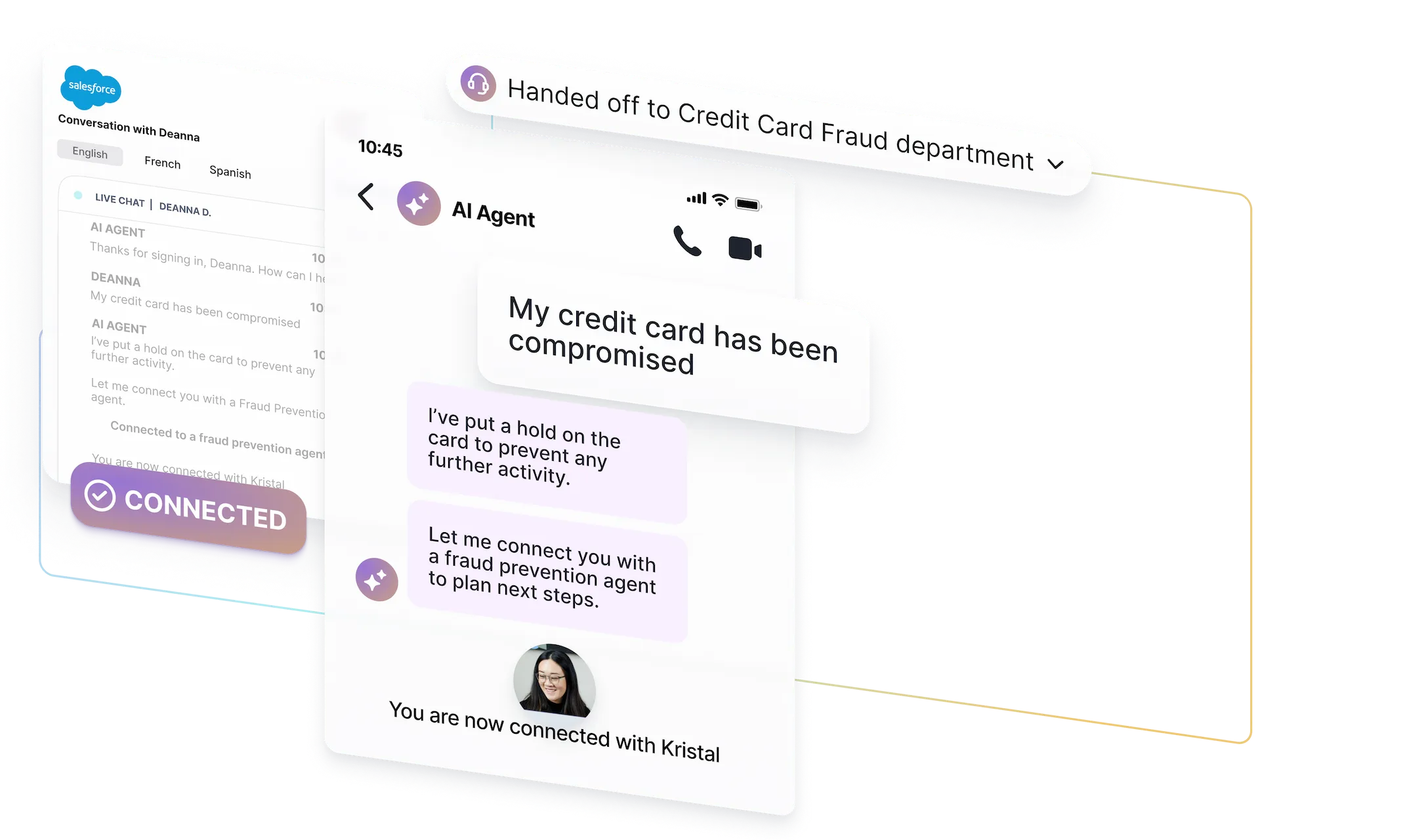

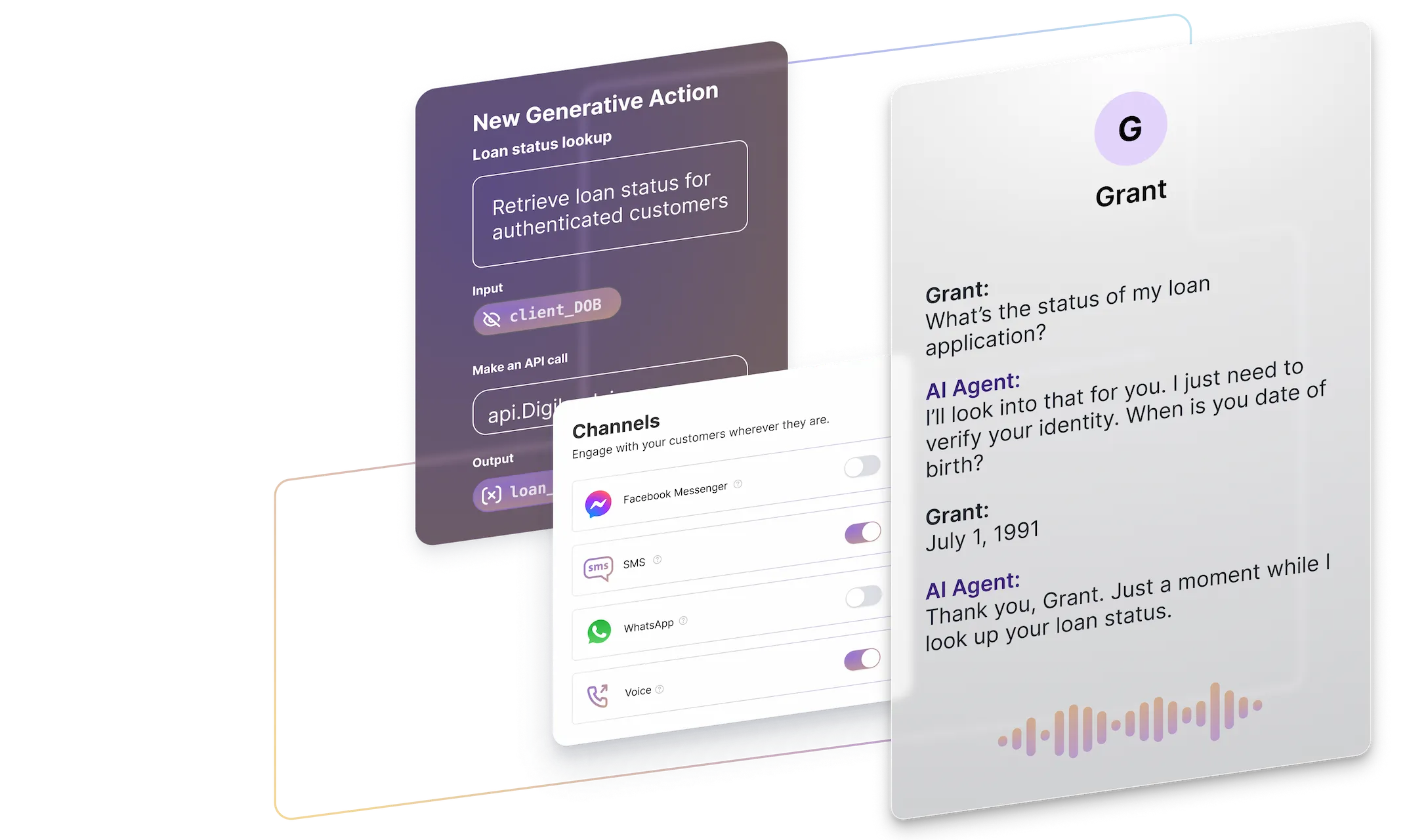

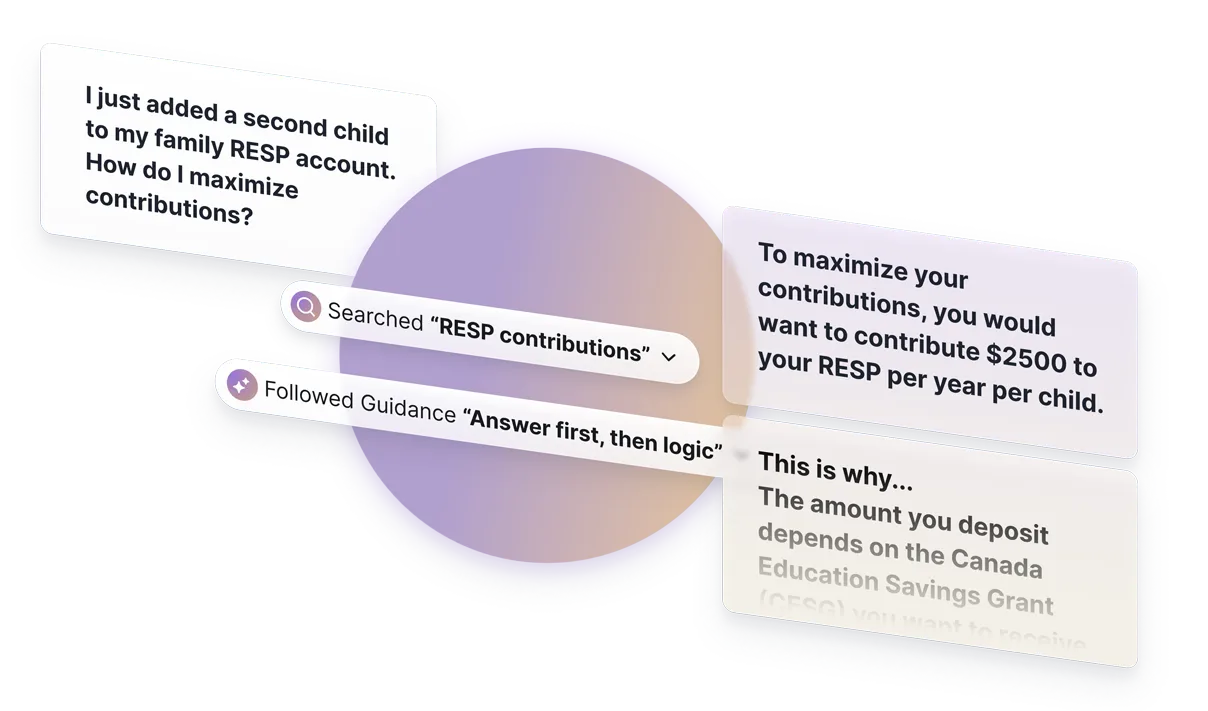

Automatically resolve inquiries. Reduce costs.

Authenticate customers and give them secure assistance on any channel, from answering simple account balance questions to details on applying for a loan.

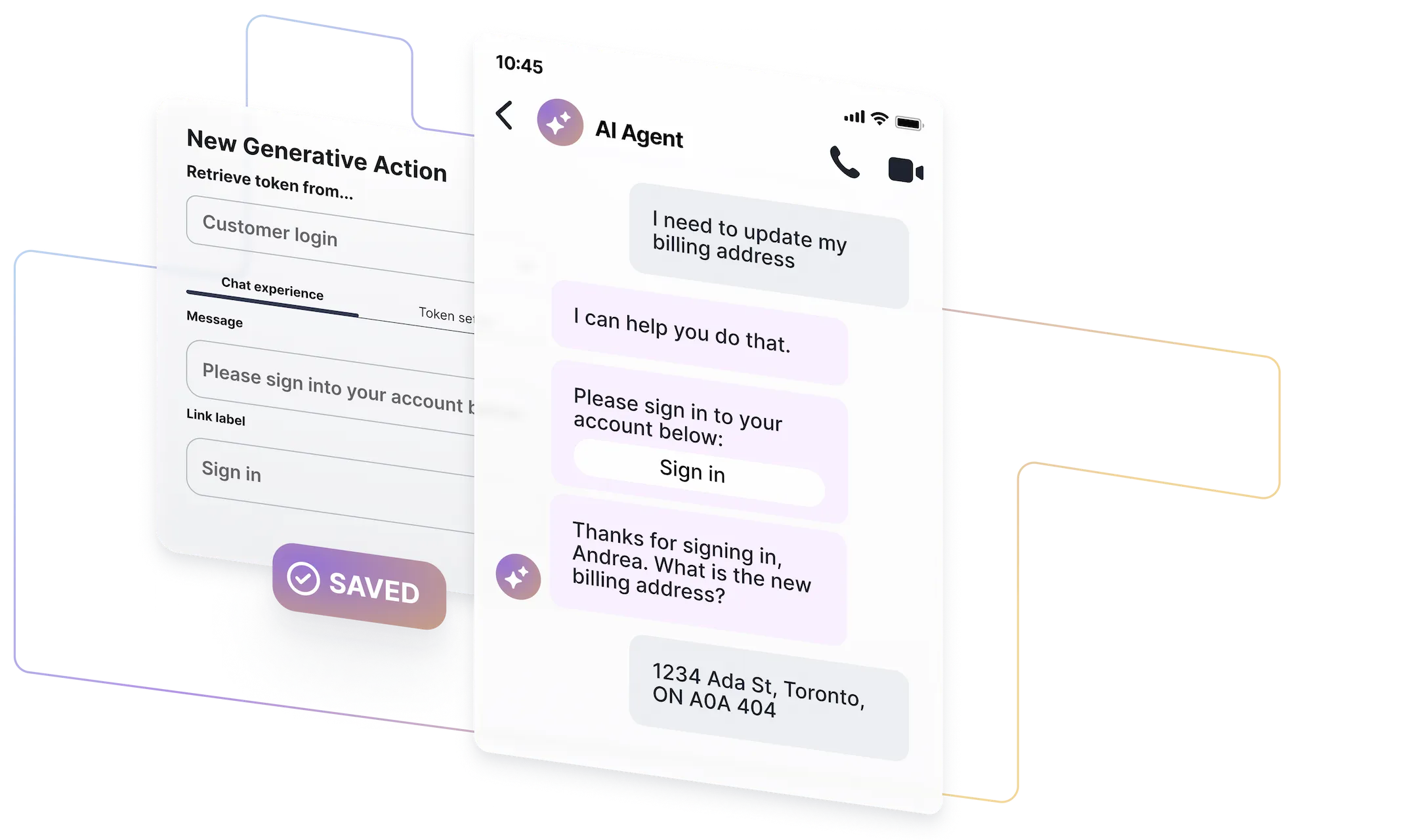

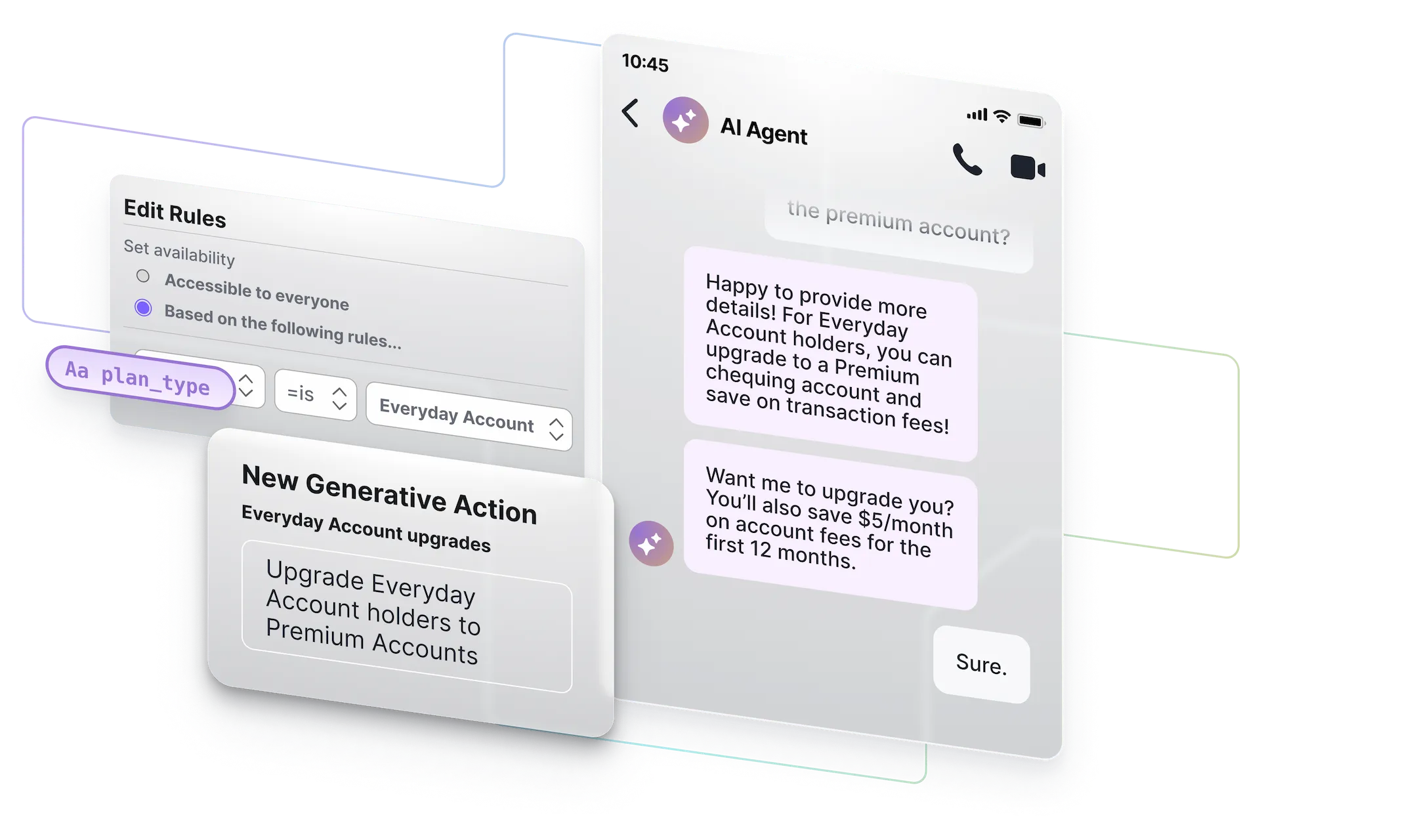

Tailor conversations with customer data. Improve service.

Deliver personalized resolutions as unique as your customer. Connect your AI Agent to your business systems so it can use profile data to perform account-related tasks.

Win, retain, and grow your customer accounts with a FinTech AI Agent.

“We can support clients where they want it, when they want it, and how they want it. That’s really important to us as a financial services company because money moves anytime during the day 24/7.”

“Ada’s Professional Service Consultants have been essential to helping us get the most out of Ada. With their guidance, our team has been empowered to go beyond simply creating content. They’ve helped us build flows that enable our most valuable customers to get the right help quickly and easily.”

Make digital banking easy

Ada's AI Agent is expertly designed for financial services, financial technology, and the banking industry.

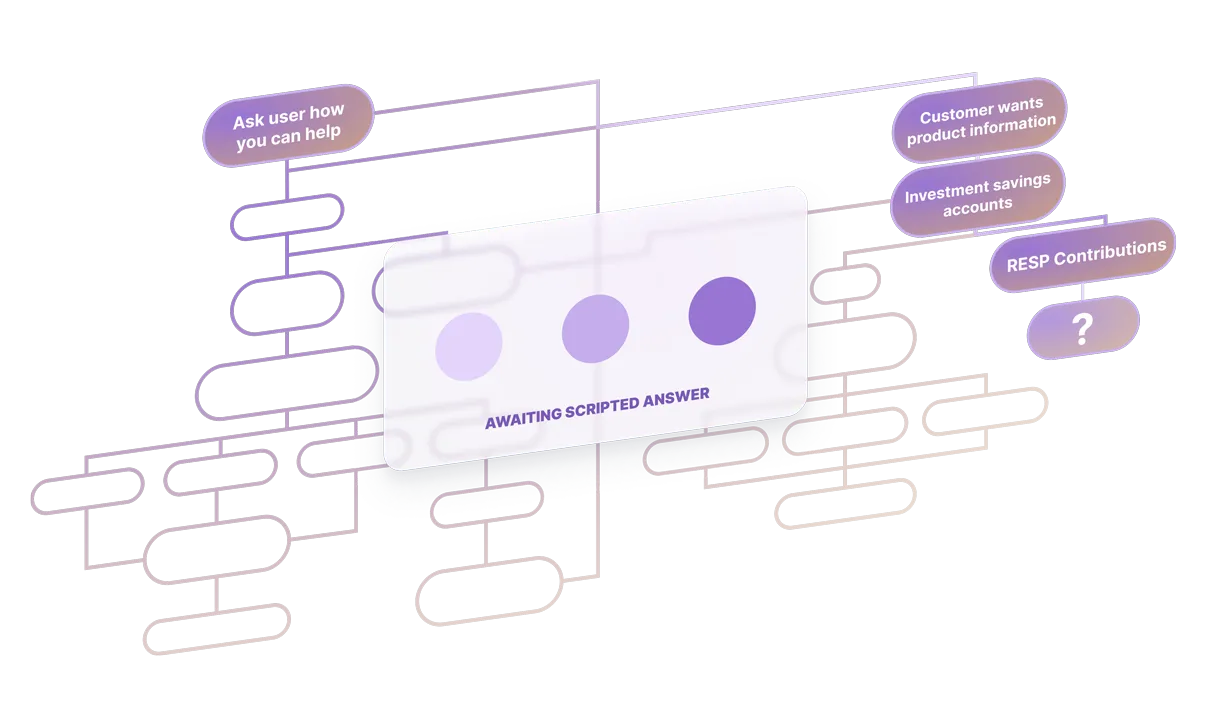

Ada’s AI Agent vs. Scripted Banking Chatbots

Unlike a basic chatbot for banking, an AI Agent doesn’t just follow a script. It reasons to figure out how to best resolve an inquiry.

Scripted Banking Chatbot

A basic conversational chatbot follows a predefined flow. Every possible customer inquiry from account updates to credit increases have to be planned for and built out.

Banking AI Agent

Rather than try to build and maintain scripts for every issue, an AI Agent reasons through a customer problem using knowledge and data from your tech stack to identify the best step to take.

Explore how AI-powered automation can transform digital banking

Businesses that onboard an AI Agent are differentiating themselves rapidly, leaving behind the limitations of traditional chatbots.

Read the Article

See how Wealthsimple doubled their Automated Resolution Rate and increased CSAT by hiring a generative AI Agent

View Case StudyKey AI customer service metrics leaders need to be tracking

All the information you need about tracking and measuring customer service success in an AI-first organization.

Get the Guide