Wealthsimple innovates in customer service with Ada’s AI Agent

The world’s most human financial company

Wealthsimple is a money management platform serving over 3 million Canadians through a unified app where investing, saving and spending come together as one. They’re on a mission to help Canadians achieve financial freedom with better and simpler financial products..

Wealthsimple takes pride in two things above all else — wealth management innovation and superior customer experience. Paul Teshima, Wealthsimple’s Chief Customer Experience Officer, believes that creating close relationships built on trust leads to a better client experience overall. Starting in 2022, his vision was to empower support agents to spend more time with customers and build closer relationships with them.

At that time, Wealthsimple was supporting their customers through email, phone, and chat via a chatbot that had been developed in-house. Christine Farrugia, VP Client Experience & Strategy, selected Ada as Wealthsimple’s chatbot partner to reduce their costs and create extraordinary customer experiences using AI.

“We pursued Ada to help us with cost savings but more importantly to make sure we are able to spend the most time with our clients who have the most complex issues. Ultimately we wanted to save agent hours and reinvest that time to support our clients in a more meaningful way.”

Aliza Africa, Client Experience Operations Systems Manager, is responsible for overseeing the technology that Wealthsimple uses to execute on their client experience vision. In 2022, Aliza’s team partnered with Ada to launch a scripted chatbot that would enable their customers to self-serve their most common questions. Ultimately, this would allow Wealthsimple’s support agents to spend more time working closely with customers to resolve complex needs, improving the overall experience for their 3 million customers. Megan Myke, Client Experience Operations AI Manager on Aliza’s team, was in charge of building and launching Wealthsimple’s initial chatbot.

Wealthsimple measures Ada’s success based on Automated Resolutions (AR), defined as conversations between a customer and a company that are relevant, accurate, safe, and do not require a human. Within a month of launching their chatbot, Wealthsimple had achieved a significant Automated Resolution Rate and associated time savings for agents. As a result, Aliza assigned additional headcount to expand the scope of the chatbot project. Their scripted chatbot had exceeded expectations and showed Aliza and her team the power of AI-first solutions.

However, Wealthsimple’s products and services are extensive, as is their support content. Manually writing scripted content in the chatbot became time consuming for Megan and her teammates. They needed a more powerful generative AI solution to grow.

So when Ada released a new AI Agent with generative AI capabilities, the Client Experience Operations team was excited to get started.

Graduating from a chatbot to AI Agent pays dividends

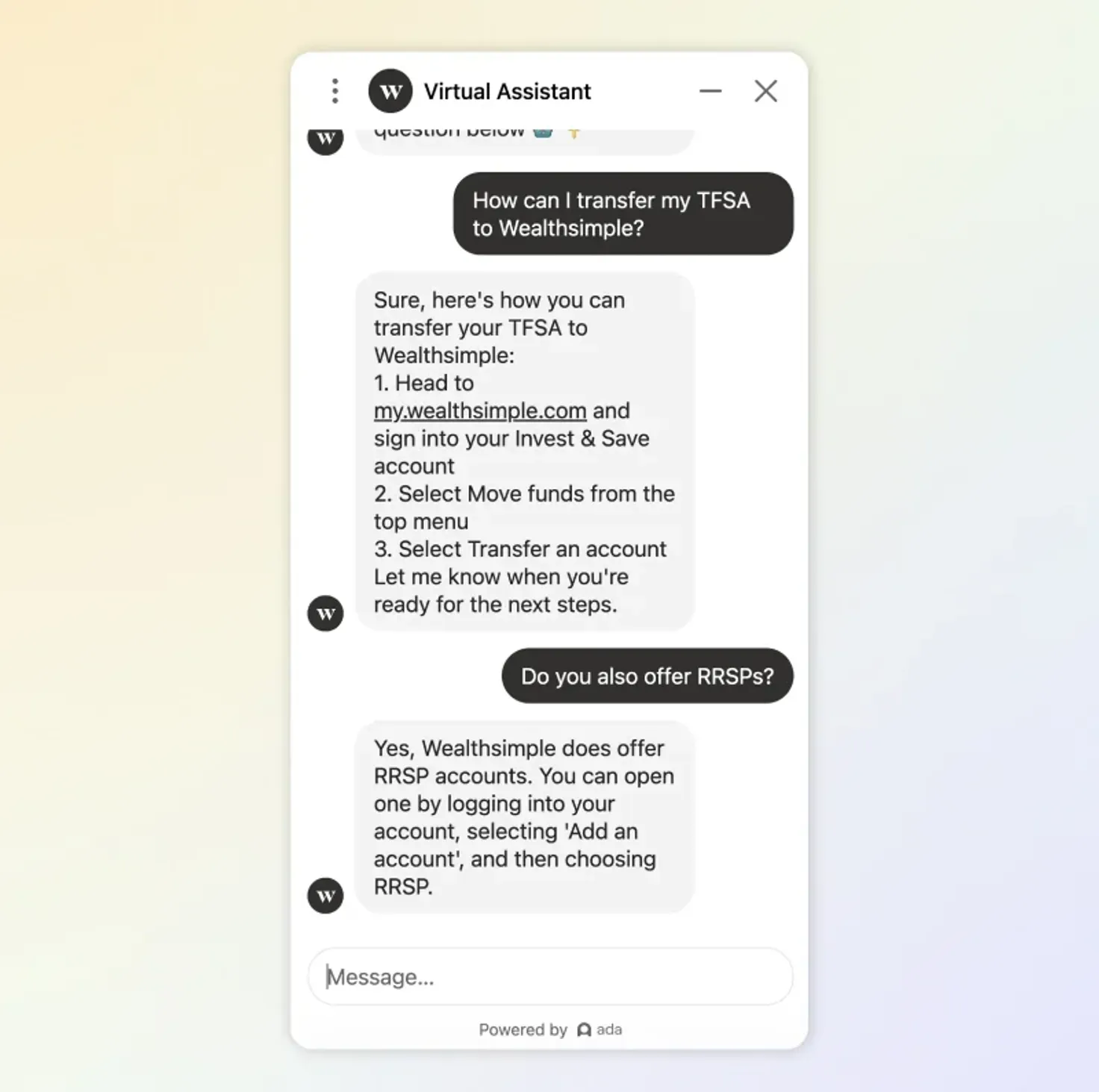

When Wealthsimple launched an AI Agent with Ada and synced it to their Zendesk Help Center, they saw immediate results that far surpassed the capabilities of their scripted chatbot. There was no further need for Megan to manually script any content — the AI Agent now pulls information from existing Help Center articles and generates answers to customer inquiries in seconds.

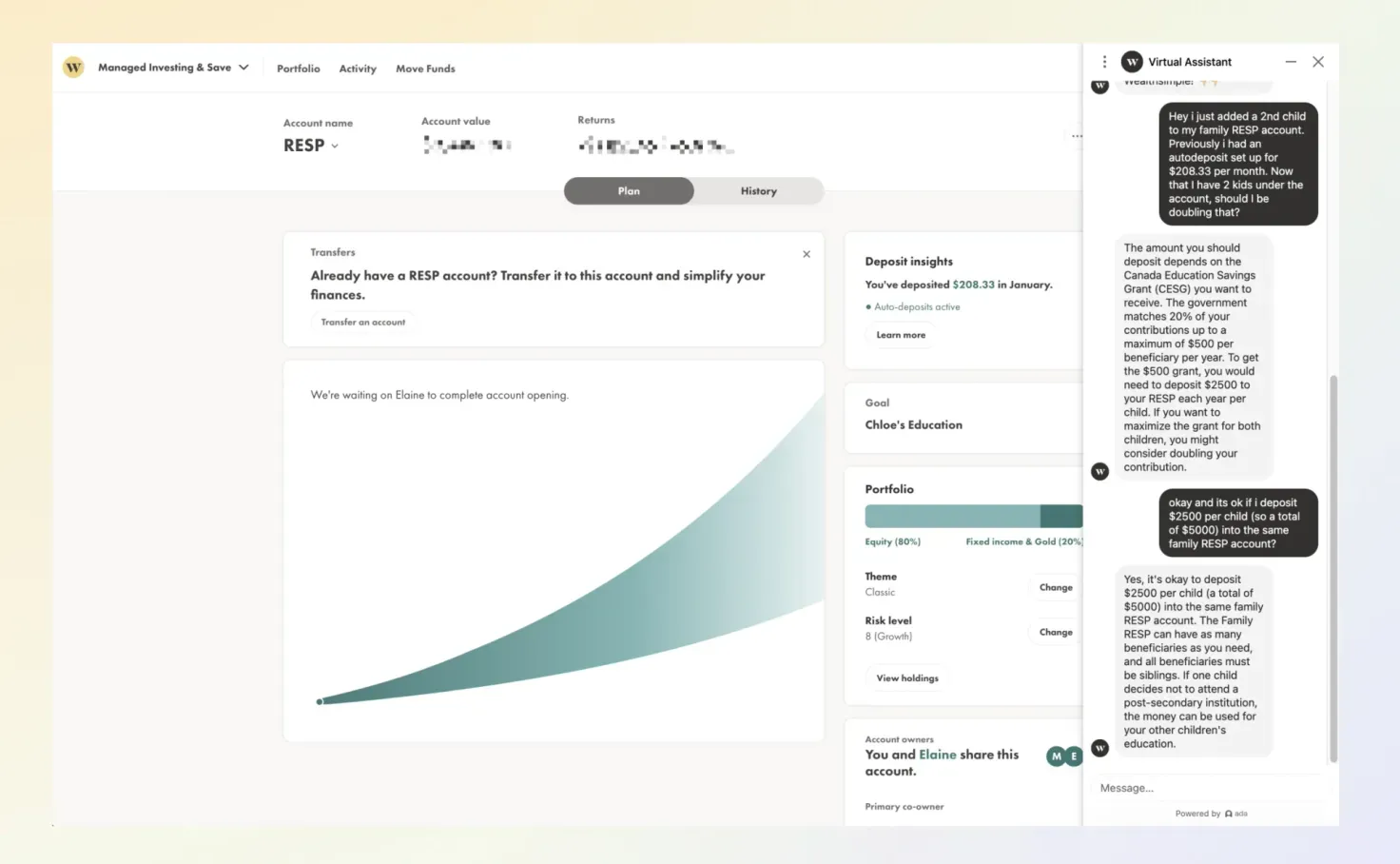

Their prior scripted chatbot could quickly answer basic questions, but the AI Agent goes a step further — it reasons through a vast collection of knowledge base articles to provide answers to complex questions. The AI Agent can automatically answer multi-step questions about Wealthsimple products, breaking information down into individual steps when needed.

Since transitioning from a scripted chatbot to an AI Agent, Wealthsimple’s Automated Resolution Rate has doubled and their CSAT has increased 10 percentage points. In other words, Wealthsimple’s customers are able to self-serve much more often. And because the AI Agent saves time and effort for Wealthsimple’s agents, they’re spending more time with the customers who really need them. All of this has led to a better experience for agents and customers alike.

With the AI Agent in place, Megan and her peers have been able to maximize their impact — instead of writing chatbot workflows, they are spending time on experimentation, analysis, and quality assurance (QA) to further improve the customer experience.

“Instead of building answer flows, we’re actually building systems that help us tackle more and more complex inquiries with AI.”

Additionally, Christine has been able to restructure the support team to develop a specialized group of agents who provide a new white-glove service for their top tier of customers.

“Based on Automated Resolutions, our AI Agent is equivalent to 10 full time agents. We’re not reducing our headcount. We’re reinvesting those agents into our business. The agent time savings we’ve realized by implementing Ada has allowed us to form a ‘gold glove’ team for our top tier of clients.”

“Our AI Agent has allowed us to scale our processes and empower our agents to spend more time with our clients on what matters to them.”

Looking ahead

As an innovator in the wealth management industry, Wealthimple is continually developing new products that help more and more people achieve financial freedom. They see their AI Agent as a way for their customers to learn about new products, ask questions, and receive more personalized service overall. Wealthsimple’s AI Agent has become another member of the client service team and an important element of the company’s strategy to get closer to their customers.

"Our AI Agent brings us closer to our clients, reducing operational burden and increasing our automated resolution to help our team think about big picture levers we can pull to create a better client experience."

Adopting new technology can be risky — especially when it’s customer-facing. With Ada, Aliza successfully did more than onboard a new technology partner — she brought a whole new category of technology to Wealthsimple. She credits her success to having had alignment with her senior leaders, Paul and Christine; the incredible work of AI Managers like Megan; and backing up her ambitious growth strategy with data.

“Be sure senior leadership is aligned on the value-add. Their support has created a lot of positive urgency and attention. And know your numbers so you can tell the story of the AI Agent in the client experience.”

“Generative AI is not as scary as people think. The AI Agent has been a great experience for our clients and for us internally. We’re now able to provide a different career path for folks on our team, and empower our agents to focus on high touch services which are more engaging for them.”

Ready to collect the dividends of self-serve banking automation?

See how you can use Ada to drive product adoption and empower customers to self-serve with helpful guidance and instant resolutions to inquiries.

Get a demo